- Use credit card rewards or cash back to pay off debt

Your credit card probably helped you get into debt, so why not use it to help you get out of debt?

If you have a cash-back card, claim your cash-back rewards every month and use the money to make an extra payment on the debt you’re working on paying off.

If you have a rewards card that lets you redeem for points or merchandise, redeem for things you’d have spent cash on such as grocery gift cards or airline tickets. Then, use the money you’d have spent on these items to make an extra payment on what you owe.

- Make yourself some visual aids

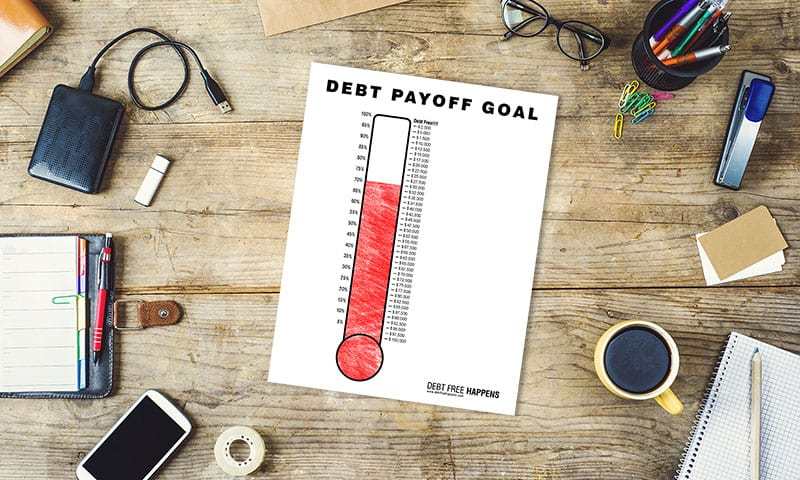

Staying motivated can be one of the trickiest parts of paying off debt — but it becomes easier if you have some visual aids to help you.

Consider making a paper chain with each link representing $100 or $1,000 of your debt (depending how much you owe). As you pay off each amount, you’ll move a chain from the link. You’ll be able to see your progress in tangible form with this approach, which could motivate you to do more to pay down debt.

You could also draw a thermometer on paper with your debt in increments that you colour in each time you pay off a set amount.

Whatever visual cues you use, the purpose is to make sure you’re able to see the progress you’re making so you actually stay inspired to send all these extra payments towards your debt.

- Create monthly challenges for yourself

Sending extra cash to debt can sometimes make you feel deprived, but you could make it fun by challenging yourself to save as much as possible in certain areas each month and send the extra to your debt.

For example, for one month you could challenge yourself by seeing how low your food costs could go by making all of your meals at home with healthy recipes using less expensive ingredients – even buying some in bulk that go a long way. Whatever you save on groceries compared to a typical month, send immediately to debt repayment.

The next month, you could challenge yourself to see if you could find only free activities to do for the month so you can redirect your entire entertainment budget to debt payoff.

If you mix up the challenges monthly, it should stay fun and you won’t feel burdened by all the extra cash you’re sending to your creditors.

- Increase your debt payments with income from a side gig

The more extra you can pay on your debt, the faster your debt will be paid down.

Unfortunately, there’s only so much you can cut out of your budget to make extra debt payments. But you can increase your income substantially by picking up some side work — and can use this extra cash to pay off what you owe ASAP.

From selling on Etsy or Facebook Marketplace to dog walking or ride sharing, options for side gigs abound. Just pick something you can do with your spare time and immediately put the extra cash towards paying off debt.

- Turn coupon savings into debt payments

Using coupons can save you money on just about everything you buy. Whether you clip coupons from the paper, print them off your computer, buy them from coupon clipping sites, or search for promo codes online, you can score big savings with a few simple hacks to the way you shop.

Any time you save with a coupon, why not use that cash for debt repayment? If your bank account is linked to your loan account, you can generally make an extra payment immediately for the amount of your coupon. This can work especially well for credit cards, which allow you to make payments as many times as you want each month.

If your lender doesn’t accept multiple monthly payments, just move the saved money into a special savings account earmarked for extra debt repayments. When you make your monthly payment, add the money from the savings account to it.

- Automate extra payments

Setting up automatic payments of your bills is a great way to make sure you don’t miss a payment. But you can and should set up automatic payments for more than the minimum.

In fact, why not try inching up the automatic payments you’re making just a little bit every week. If you’re paying an extra $100 on the debt you’re working on paying down, try upping that automated payment to $125 this month and then $150 next month.

By slowly increasing the extra payment, you probably won’t miss the extra cash. Just keep inching up that payment amount until you find you really can’t live on what’s left. Then scale back a bit.

- Enlist the help of an accountability buddy

For dieters, there are tons of groups where you have to go each week and weigh in. This helps keep you accountable — and it can also make losing weight more fun when you’re doing it with others.

Why not try the same approach to debt payoff? If you have one or more friends working on paying down debt, set up weekly or monthly check-ins. You can each share the progress you’ve made towards becoming debt free, and can even exchange tips and tricks on how you’re cutting spending to pay off what you owe.

If you are still struggling with paying down the debt and you are doing your best, call the Rita Anderson & Associates Team to help you develop a great plan & put you on the road to good financial health.